Award-winning PDF software

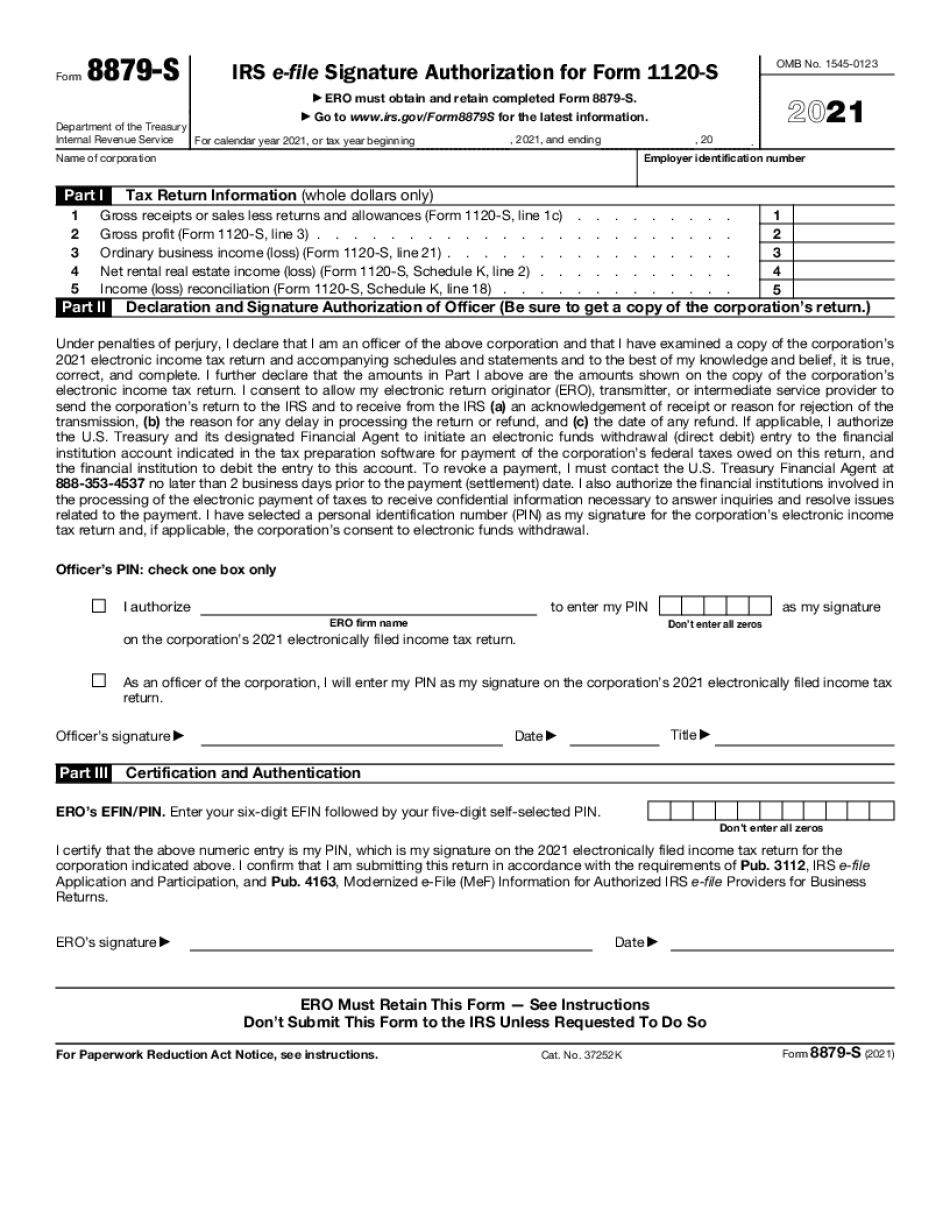

Form 8879-S for Franklin Ohio: What You Should Know

It is used to create a fake return to trick the Internal Revenue Service in claiming a larger deduction on its federal tax liability. If the excess of tax over the allowed deduction is more than allowed, it can be transferred to a third party. In order to transfer the excess over the claimed deductions, the false return is submitted (by mail) to the third party, usually a tax preparer who has not yet been named with the government for the fraud. Mar 29, 2025 — A woman from Phoenix, Ariz. Was the recipient of fraud from an individual using a shell company. She submitted a tax return and received a check for 40,000. However, the check was not cashed until January 2013. Mar 29, 2025 — The woman was told that the refund would arrive in three weeks. She also was told that the check and the check stub for the check stub were needed to pay the tax. Mar 29, 2025 — The woman then contacted the IRS and the agency referred her to the Fraud section of the Taxpayer Advocate's office at the FTC. That office sent her a letter demanding additional information and inspecting her tax return. The letter said it was against the law for her to send the false return and that further action by the woman would be considered criminal fraud. April 6, 2025 — The FTC sent another letter to the victim (after her filing of the fraudulent tax return was dismissed by the IRS). However, the victim was not able to find the victim-advocates office where she had been assigned, and this time she was not assigned to a fraud prevention officer. She was instead assigned to the Employment unit at the IRS. Apr 10, 2025 — A second letter was sent from the FTC to the victim. The second letter was about a year after the first. The second was about a year after the agency had been alerted about an investigation, or a suspicious refund return. That's when the agency learned that the victim was not a customer of the agency but another fraud victim. The Victim called the agency fraud line) to talk to the IRS. That was a few weeks before she filed the fraudulent return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S for Franklin Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S for Franklin Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S for Franklin Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S for Franklin Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.