Award-winning PDF software

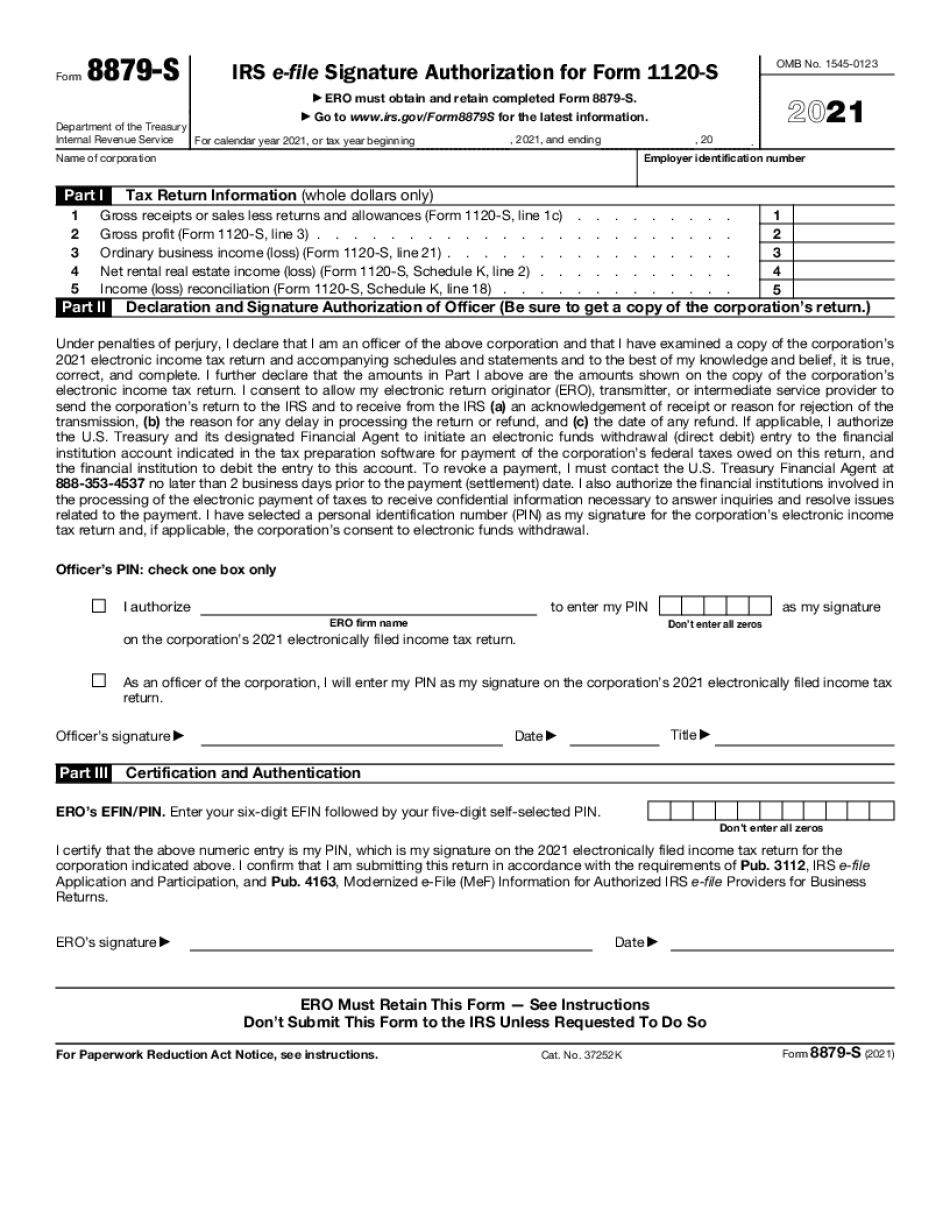

Form 8879-S Jurupa Valley California: What You Should Know

Moreno Valley California Form 8879-S For 2 Tax Year 2019 2016 Form 8879-S for Calibration Test Moreno Valley California Form 8879-S for 2 Tax Year 2017 2016 Form 8879-S for Calibration Test Moreno Valley California Form 8879-F for 2025 Tax Year 2016 Moreno Valley California Form 8879-F for 2025 Tax Year 2015 2016 Form 8879-F for Calibration Test Moreno Valley California Form 8879-F for 2025 Tax Year 2014 Moreno Valley California Form 8879-F for 2025 Tax Year 2013 Moreno Valley California Form 8879-S for 2025 Tax Year 2012 Moreno Valley California Form 8879-S for 2025 Tax Year 2011 Moreno Valley California Form 8879-T for 2025 Tax Year 2010 2016 Form 8879-S for Calibration Test Moreno Valley California Form 8879-S for 2025 Tax Year 2014 Moreno Valley California Form 8879-S for 2025 Tax Year 2013 Moreno Valley California Form 8879-F for 2025 Tax Year 2012 Form 8965-P — California Self-Employed Individual Income Tax Return. California is a self-directed retirement system for all individuals or employers in certain specified circumstances. To participate in the California program must be a California resident, an employer or sponsor of any individual who is a California resident, an independent contractor or consultant, or a participant in a group or group of contractors for purposes other than the employment of individuals within a specified class of subcontractors. An individual cannot be an employee and are eligible to participate in the self-directed retirement system to receive a Retirement Plan Account. The purpose of claiming the California tax deduction on Schedule A for the retirement plan contribution deductions is to reduce the amount of tax due on the return of a Distributive Share Amount that is subject to the California self-employment tax. Moreno Valley California Form 1141 This document is an application for a Form 1141, Employer's Qualified Proposed Election for Tax Withholding. It must accompany the Individual Income Tax Return for the tax year. This forms may be used during the filing process, but do not appear on an annual tax return. Form 1212-1 — California Certificate of Tax-Based Certification This form is a certification and claim form for a tax or other payment that was made to the State of California that does not require payment to a federal entity.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S Jurupa Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S Jurupa Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S Jurupa Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S Jurupa Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.