Award-winning PDF software

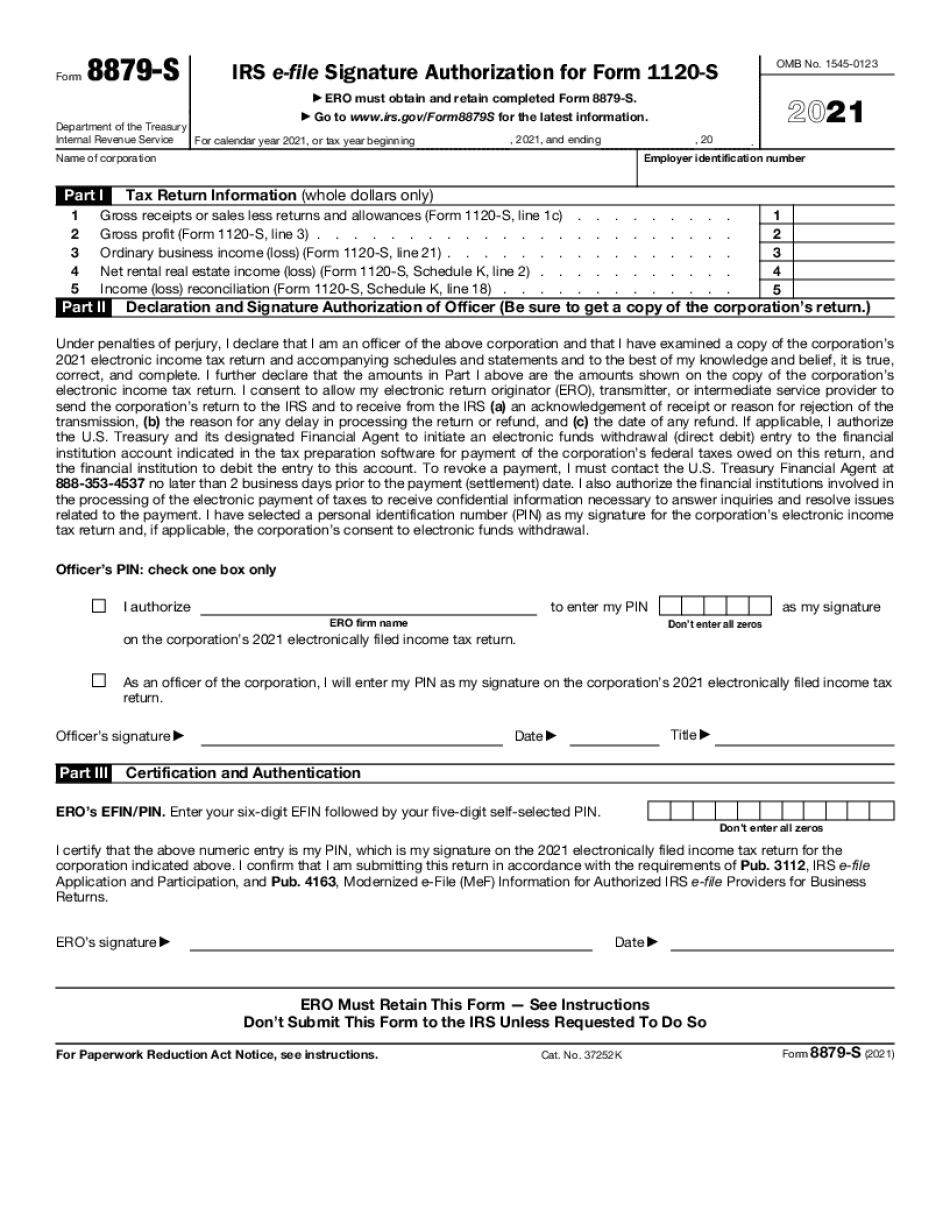

Form 8879-S Houston Texas: What You Should Know

Internal Revenue Service. 3. How to File a 1120S with a Texas Sales Tax Return The ERO will receive the completed Form 8879-S (PDF is best) and return the form for them to mail to you (1120-S) for you to file with your state tax agency. 4. Why do I need a Texas Sales Tax form? All returns will start out as “C”, because all tax returns need to start as C. If you do not have a TX address for your state, you will have to file it as F instead. When the state agency receives your Form, they will create a completed 1120-S to tax as a “Sales and Use Tax Return”. They will ask you to take a copy of the completed 1120-S (the return that you had to file with your state) and a copy of your Texas sales tax sales slip to your TX address. The Sales Tax State will use both copies of the form to tax all your purchases as a “Sales and Use Tax Return”! 5. The tax code for your state is in the following table: Alabama Arkansas Arizona California Colorado Connecticut Delaware Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Guam Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming 6. In order to use this tax-exempt form, fill out the correct portion of every line — no matter what state name it appears in — and the correct numbers and dashes — for the correct state and the correct amount of sales tax. 7. Will an item you purchased on eBay or to go on sale come out as a taxable sale if you choose to file Form 1120-S? Of course, the “eBay” label (if there is one) is not included on every item in our auction as it is not included with “Sale of Goods.” On eBay, however, it is necessary to enter the "eBay” label. If you do not do anything else to the item you intend to auction, the eBay label will simply be there to help you determine what taxes you will have to pay. 8. Can I use an existing sales tax return? To pay for our services for your 1120-S, you should create a sales returns in your state. You will need your state tax identification number (i.e.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.