Award-winning PDF software

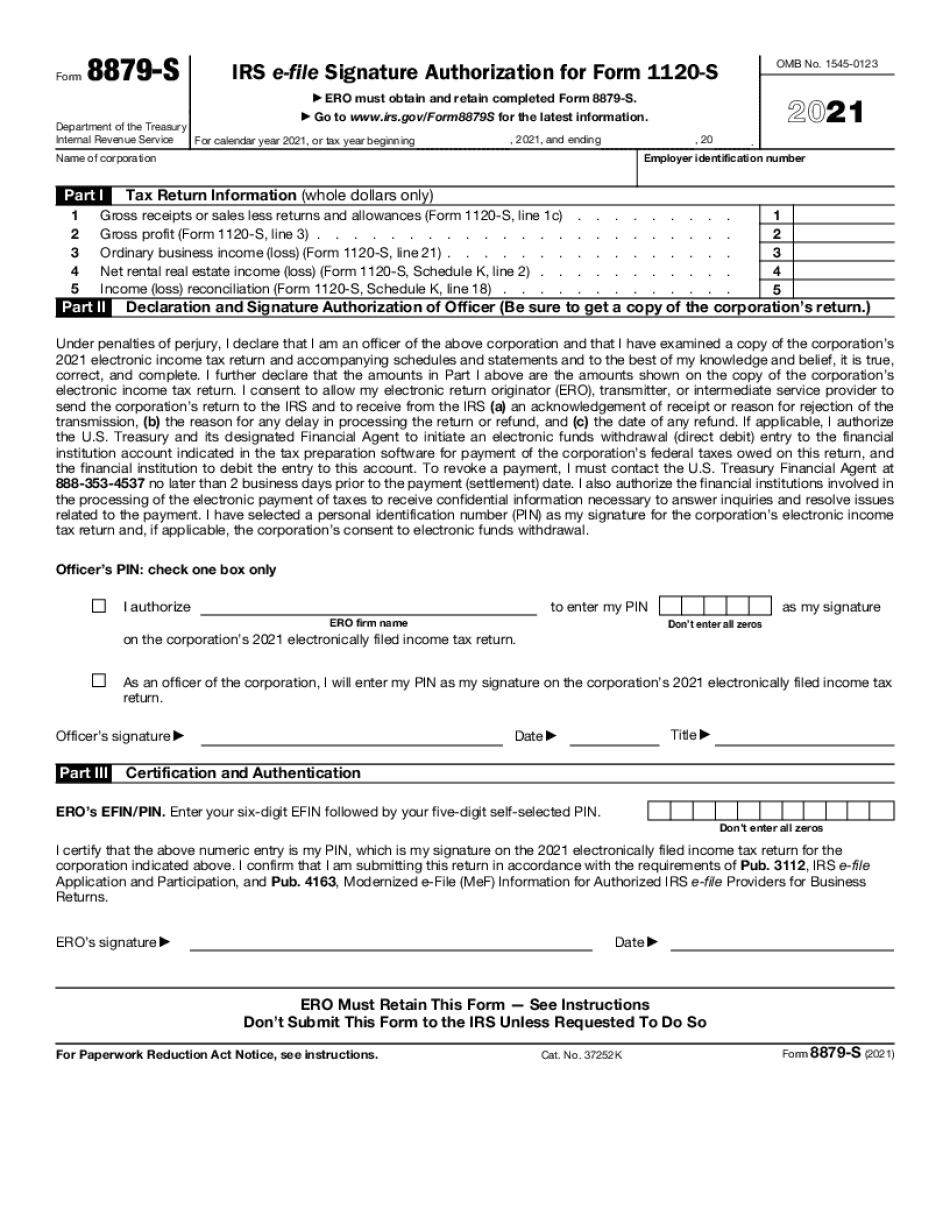

Form 8879-S for Georgia: What You Should Know

Taxpayer Information Packet. Complete form for Georgia. If Form 8879-S is not received by the ERO by 7:00 p.m. (EDT on May 22, 2022) an extension deadline notice will be mailed to the taxpayer and a refund may not be processed if the date of tax filing is later than April 15, 2022. If the ERO does not receive the Form 8879-S within 10 working days, or a later extension is granted, the taxpayer may elect to have a credit of 60 percent of any tax paid not paid by the due date. The taxpayer may apply for the “Estate” credit using this form. All taxpayers who will have a credit will need to check off the box on this form, under “Other Items” Estate for Georgia Taxpayers is made easier by this form. Estate for Georgia Taxpayers provides information relating to: 1. Estimated annual gross and net gain or loss, net of any deductions and credits, including the cost of any real or personal property the taxpayer owns 2. Taxable estate 3. Estimated estate tax, including exemption amounts and the maximum amount due 4. Exemption amount 5. Exemption date 6. Exemption period 7. Federal and state estate tax on married individuals filing jointly, and on other married persons of the same sex, whether they file a joint return 8. Exemption from Georgia estate tax 9. State property tax on taxable decedents, widows, and orphans 10. Exemption for spouses filing jointly, or for each of them if one spouse is age 65 or older 11. Credit for Federal and state pension expenses 12. Credit for Federal and State tuition and related expenses 13. Exemption for contributions to educational institutions 14. Exemption for contributions by the estate of deceased taxpayer 15. Credit for contributions to charitable organizations 16. Credit for Social Security benefits paid to taxpayers. Form8879-S includes this information and additional related tax-related information Electronic filing forms, instructions, and tax calculators are available at: The Georgia Department of Revenue website. Georgia Depreciation and Amortization form, includes Information on Listed Property. 500 Individual Income Tax Return of Georgia Resident Individual, Georgia Depreciation and Amortization form, includes Information on Listed Property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.