Award-winning PDF software

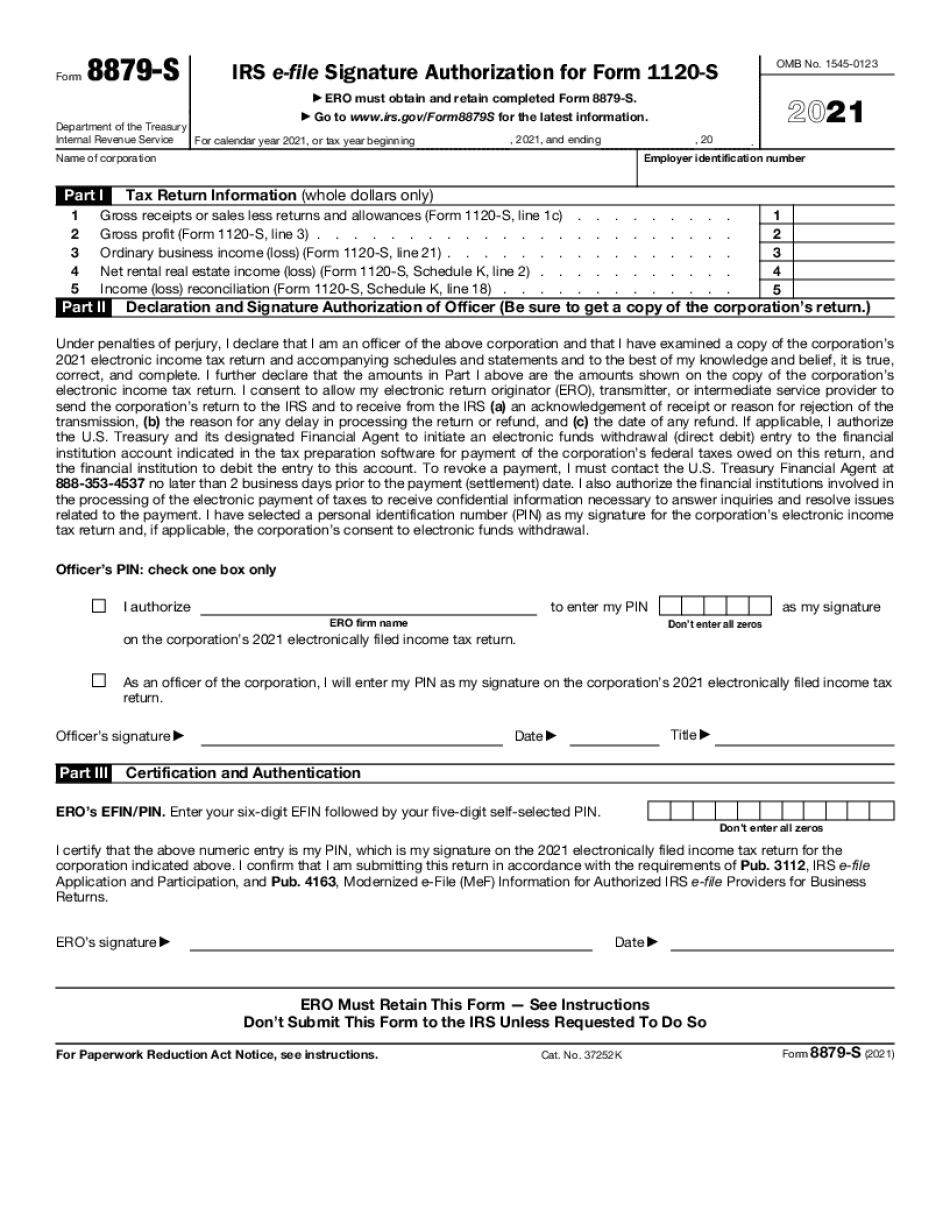

Springfield Missouri Form 8879-S: What You Should Know

May 14, 2025 — A paper filing option for the federal tax return was recently announced by the Treasury Department. If the taxpayers are not required to file by paper, we may be able to provide electronic filing services for taxpayers who do not currently receive paper filing services from our organization. The best-practice approach and most common problems associated with electronic filing for federal income tax returns can be found in the following link: IRS e-file May 10, 2025 — In recognition of the many ways Americans pay their taxes, the General Accounting Office last year issued its report Taxpayer E-Filing, recommending that taxpayers using e-filing software programs be prepared to accept paper returns for filing. May 3, 2025 — The IRS and its contractors have created an e-filing system that collects and processes electronically filed data electronically, but taxpayer privacy remains a concern in this era of increasingly complex, interconnected, and sensitive financial data. “Taxpayers should always remember we do not store personally identifying information (PIN) that is transmitted electronically. Rather, the taxpayer's personal information is stored on a separate, secure database accessed through an IRS Access Center in a secure, encrypted environment that is not shared with any other government entity.” The IRS's e-file website states: We cannot assure any security measures are adequate to protect against data loss or security breaches, but do provide customer support as necessary and available to address any concerns. Once a taxpayer files, we cannot and do not access the taxpayer's information beyond the date the income tax return was filed.” If taxpayers do not want to accept paper filing of their federal income tax return they may file electronically. The return, Form 1040, (PDF) is completed in the same manner in which a paper return is completed as well. The following IRS link provides further information about Paper vs. e-file filing: If a taxpayer is required and chooses not to submit their federal tax return using a paper filing option, the electronic filing system will automatically transfer the information from the individual's returns to the IRS system. If the electronic returns contain a significant amount of sensitive data, we will immediately delete the material.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Springfield Missouri Form 8879-S, keep away from glitches and furnish it inside a timely method:

How to complete a Springfield Missouri Form 8879-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Springfield Missouri Form 8879-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Springfield Missouri Form 8879-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.