Award-winning PDF software

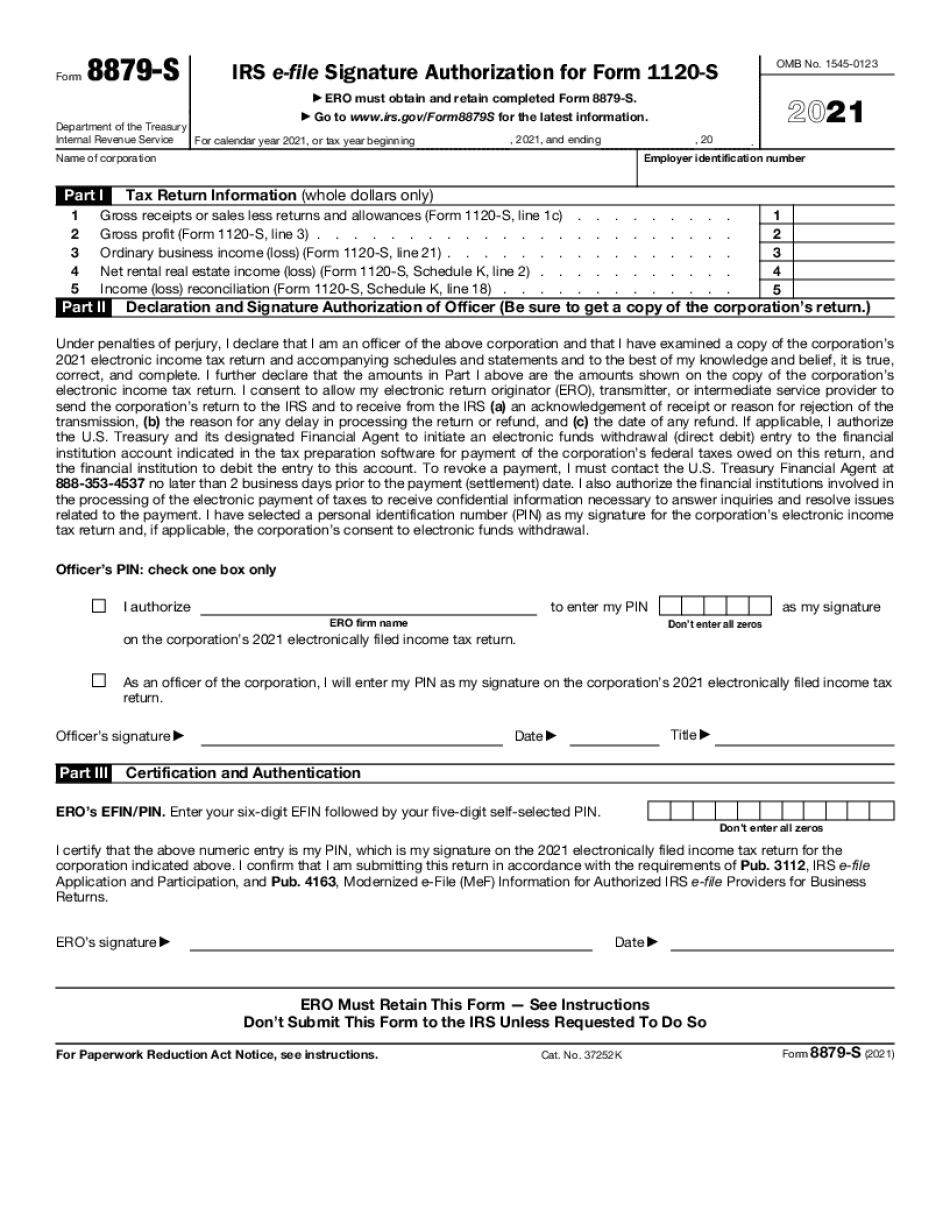

Printable Form 8879-S Broken Arrow Oklahoma: What You Should Know

This Form is revised from 2025 Form 8879-S Form 8879-S (Form 8976) Paperwork Reduction Act Notice for the Tax Year 2016. This form is also revised from 2025 Form 8879-S Paperwork Reduction Act Notice for the Tax Year 2015. Also see these links for a full description of the Form 8879-S Form 1120S Form 1120S (2017). Note that this Form also provides instructions. OMB No. . For calendar year 2021, Prosy stem FX Tax User Guide.pdf — CCH Support CCH Prosy stem FX Tax is the professional software system that integrates and manages your tax processing and office administration. CCH Prosy stem FX combines The best 10 Fingerprinting in Broken Arrow, OK — Yelp Form 1120S This page should be considered the official version of Form 1120S. This is also available on your computer, by mail or fax: The Form 1120 and the Instructions/Terms of Use are available in the Documents link on the IRS.gov home page. IMPORTANT NOTICES If You File a Form 8879-S or a Form 8875-S You May Not Be Eligible to File a Tax Return If you are required to file a tax return, and you signed the original form 8655, and you now file a Form 8879-S or a Form 8875-S. If you have not previously paid any tax you are required to file a tax return. If you are no longer required to file a tax return and do not sign a new form 8655, you must pay the tax you owe on the first day of the tax year that begins after March 5, 2018, including the additional tax due. You will file a return on the return date. This year, beginning with the 2025 tax year, taxpayers no longer have an additional 100 per month penalty if they do not have a Form 8888, Notice of Federal Tax Lien, or claim this exemption if their annual income is below the filing threshold. For more information see Refunds. You May Qualify For the Alternative Minimum Tax If You Amended Your Tax Return If any section of Form 2106 is changed, it may no longer apply to you. You may change your income tax filing status by applying for an amended return to show those changes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8879-S Broken Arrow Oklahoma, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8879-S Broken Arrow Oklahoma?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8879-S Broken Arrow Oklahoma aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8879-S Broken Arrow Oklahoma from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.