Award-winning PDF software

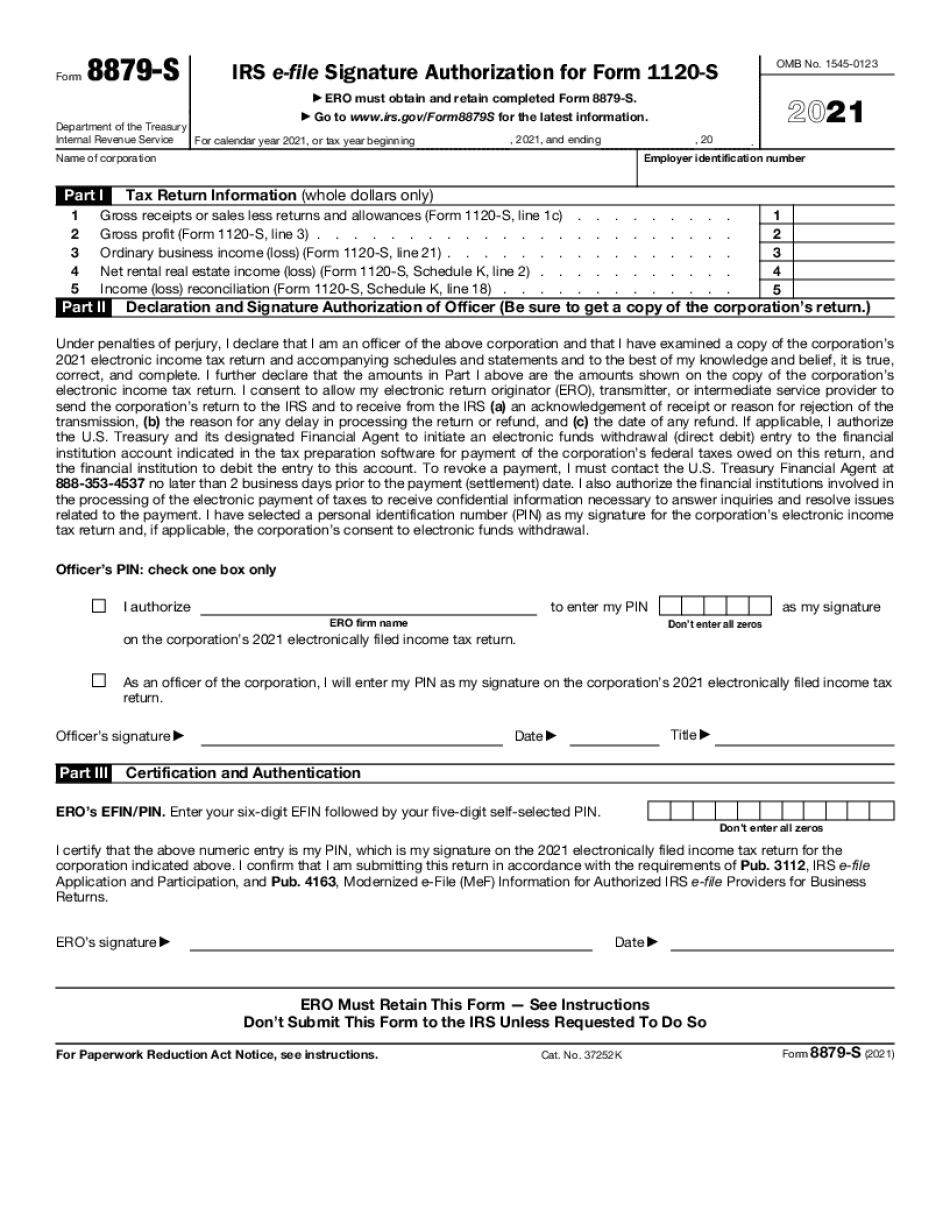

Modesto California Form 8879-S: What You Should Know

Here's my Form 8879-S from this month's letter filing for 2025 California Individual Income Tax Release Date! I will be filing for the same IRS-eligible taxpayer again this tax year! What do you think? Here's how you can prepare your own California individual income tax return by using this free, downloadable IRS e-file program. I hope you find this free software useful, so that you can file your taxes as quickly, correctly and efficiently. Download the free IRS e-file program here. IRS e-file for 2025 California returns This month you can download tax forms from the IRS that have been prepared for a select group of California taxpayers who can e-file their individual income tax returns for the tax year ending on April 30, 2018. Individual taxpayers who qualify may be able to use the online e-file software developed by File. If you are an individual taxpayer, and qualify, you can file and e-file your tax returns using the online software. Individuals without qualifying income (for example, self-employed individuals, sole proprietors) should contact their state department of revenue to determine if they need to file an individual state tax return. This is the best use of your tax refund from last year's California state income tax. And with this software, you can print up your returns, save receipts, and even have paper copies mailed to you when you have the IRS. You do not need any hardware or software to use this free e-file software. Just complete these steps: Select the state of California where you plan to file You can enter any of the state or county areas (the full list can be found in Efile's FAQ), but choose one. You need to enter the ZIP Code in the top right of the page. Click Continue to Enter a valid address for yourself. This is the place where you will get your paper tax return. A valid address includes your current home address and your mailing address in California. It will also work if you move to a different ZIP Code at a later date. Note that you can use it to save the receipt number, too, so that you can provide that to the IRS when you file. You'll be asked to update your address. Just click Continue again. Enter your Social Security Number (SSN) and password Choose To confirm & Enter the new address Then click Continue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Modesto California Form 8879-S, keep away from glitches and furnish it inside a timely method:

How to complete a Modesto California Form 8879-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Modesto California Form 8879-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Modesto California Form 8879-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.