Award-winning PDF software

Form 8879-S Renton Washington: What You Should Know

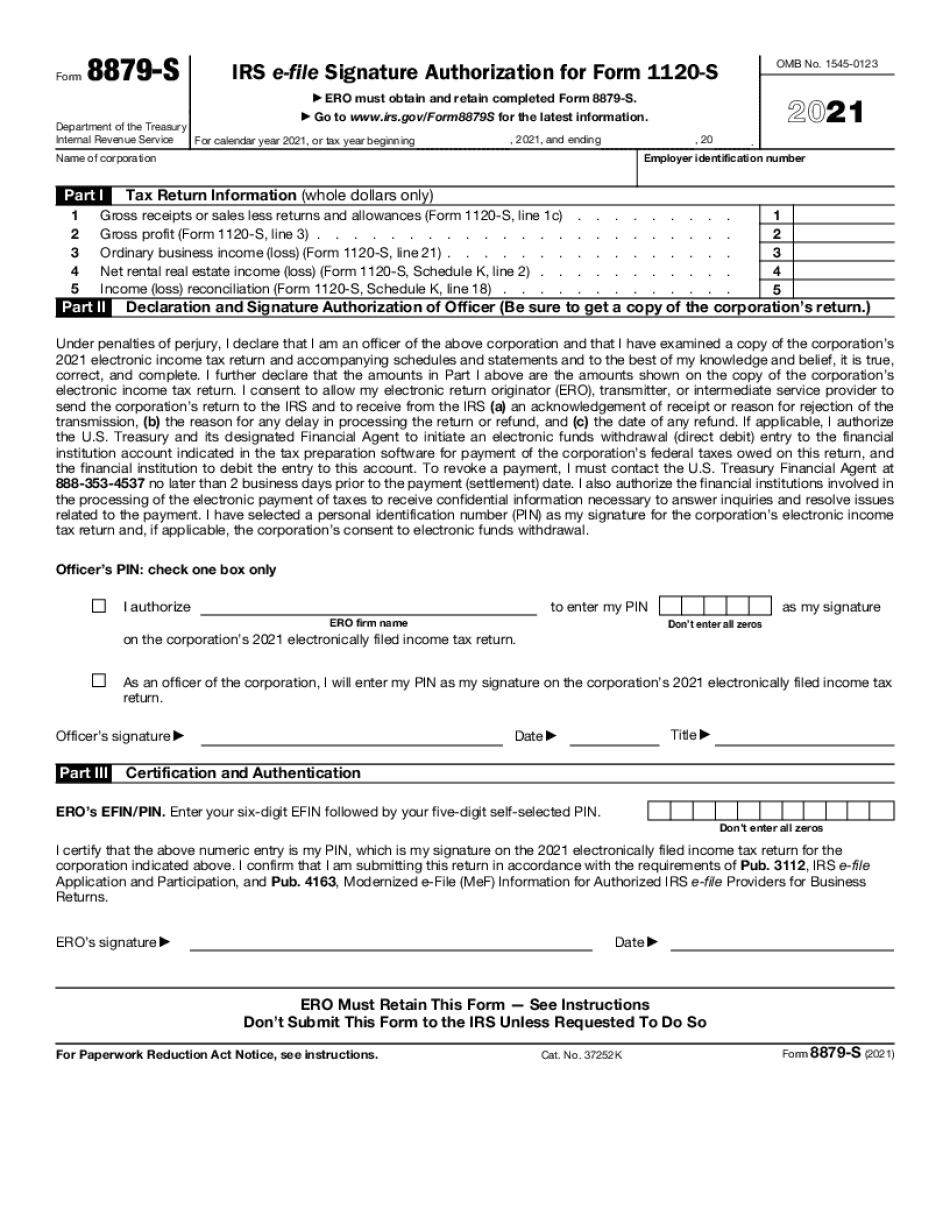

SUITE 120-A Renton WA 98057 ETA: Feb 8, 2563 BE — If your return is missing the taxpayer must sign the 8879, but all other information is the same. When was 8879-S Issued? The ERO is expected to have e-file Signature Authorization for Form 1120S by Dec 5, 2017. Informant information for Form 1120-S Date: 08/12/2018 Please note ERO received this information on October 9th, 2663 ETA. You cannot sign it yourself! We know this is a great feature for tax season, but if you are still unsure, email us at, and we'll help you out! Form 8879-S is available to tax filers who did not pay an additional fee. A signature with additional information is required. If you paid a signature fee to have your return automatically validated during the verification process, there is no additional fee for e-file. Signatures are required on the following documents by law. Paper Form 8879-S: 13.00 — If you signed online or by mail, get back to us. Taxpayers Must Get Signed Tax Forms Some filers might be able to request e-file from our e-file service provider by using the “Tax-Filing Form ID” at. The tax law is very clear, all filers need their tax returns signed. Failure to get this type of signature automatically results in non-payment and no tax owed. Form 8879 is available to taxpayers who filed a paper tax return (without an automated validation process and without providing a signature by paper form). You cannot have non-tax returns mailed back to us unless the form is electronically signed and dated. Please note, your e-file signature must be the same signature you used on the paper return form you received. The information provided is “as is.” Please do not use this information to prepare any tax-related documents or claim any deductions or credits. This information may be shared with the IRS for purposes of a valid e-file signature authorization, including filing in connection with a tax return, and for administrative purposes related to e-file. E-Filer ERO — EEO is the entity authorized by an IRS e-file agent to perform the authorization process for e-file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.