Award-winning PDF software

Form 8879-S online Green Bay Wisconsin: What You Should Know

Form 941 for the first four months of 2021. If you are still a preparer the IRS is still required. There is a new federal tax form for e-filing your Federal income tax return. The United States Department of the Treasury and the Internal Revenue Service are issuing a revised Form SS-4 for Individuals with Income Over 200,000, Effective For Tax Year 2017, to comply with the new Affordable Care Act. Filing your 2025 tax return online now (2018 tax year) with eFileNow (you will not be notified of a change in your account) is no longer required for individuals who file as individuals when filing their income tax return. If you are filing as a partnership when you file your own tax return a separate form SS-4 must still be completed for each partner in order to file for you. It looks as if there might be a few more people at the office today. One was an IRS official from Green Bay. They seemed concerned about the number of people around the office and wanted to make sure everyone is okay. That was my worry when I asked about it, too. I thought maybe someone got a virus and is sick. I would get a call just as soon as I could. I also have had a couple of comments from those who think the IRS office is getting busier and more people are coming by to get filing services. This is the kind of stuff it was like when I had our home office for many, many years. I loved working there, and it was a good place for my clients. It was also important for me to keep the IRS from losing the case. But now I worry that this may not be such a good thing because they will have to work harder to keep up, which means fewer people will show up for their services, and the IRS will lose the case. As I said, I hope that is not so. I would rather have the case get lost than for the IRS to lose a valuable case. Some people think the IRS will have to change its office layout to accommodate the extra demand. There may be some issues with the parking lot, and there may be new construction. I am just an office in the world and I do not know everything. Also, I have not heard of any new filing centers. My office can't take all of them, though.

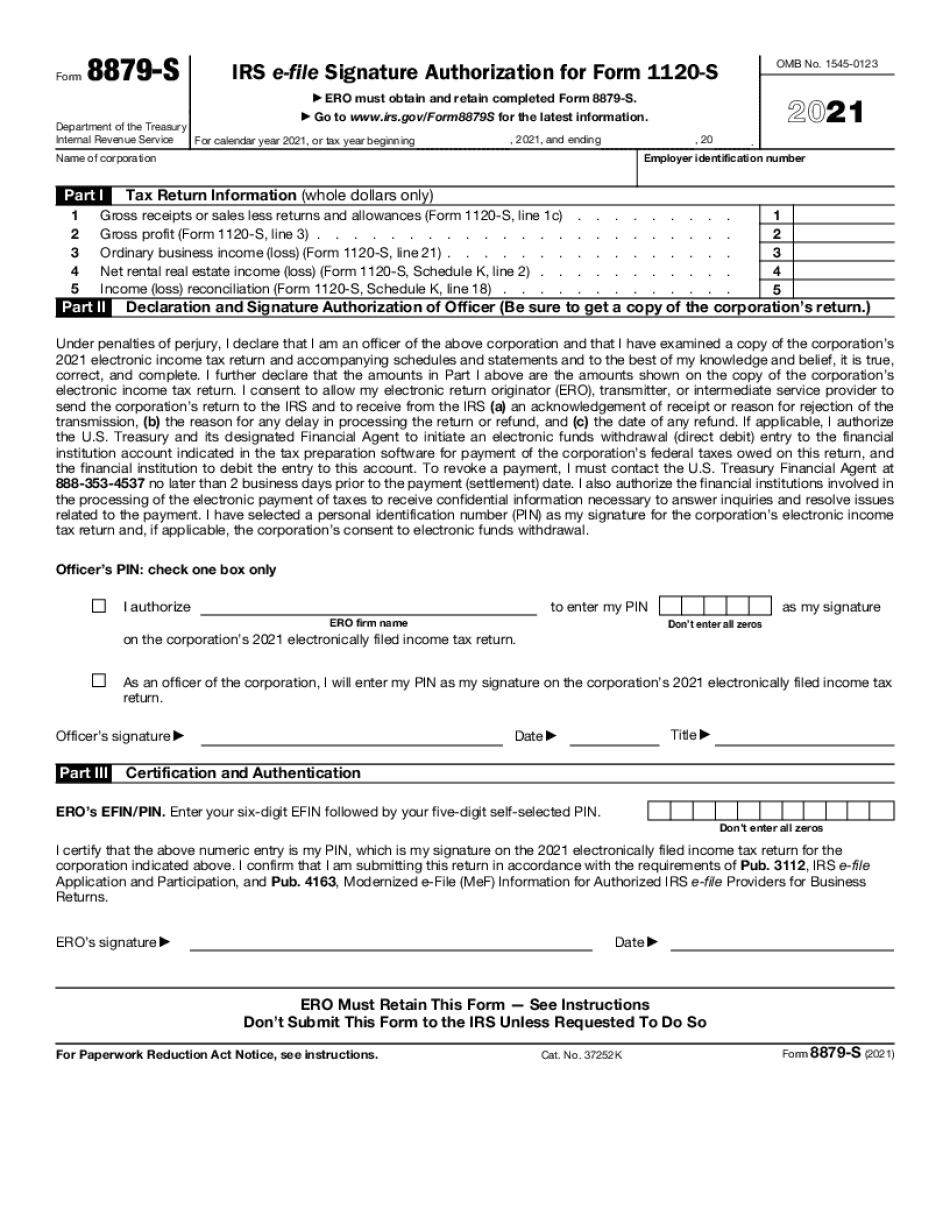

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S online Green Bay Wisconsin, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S online Green Bay Wisconsin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S online Green Bay Wisconsin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S online Green Bay Wisconsin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.