Award-winning PDF software

Form 8879-S online Carrollton Texas: What You Should Know

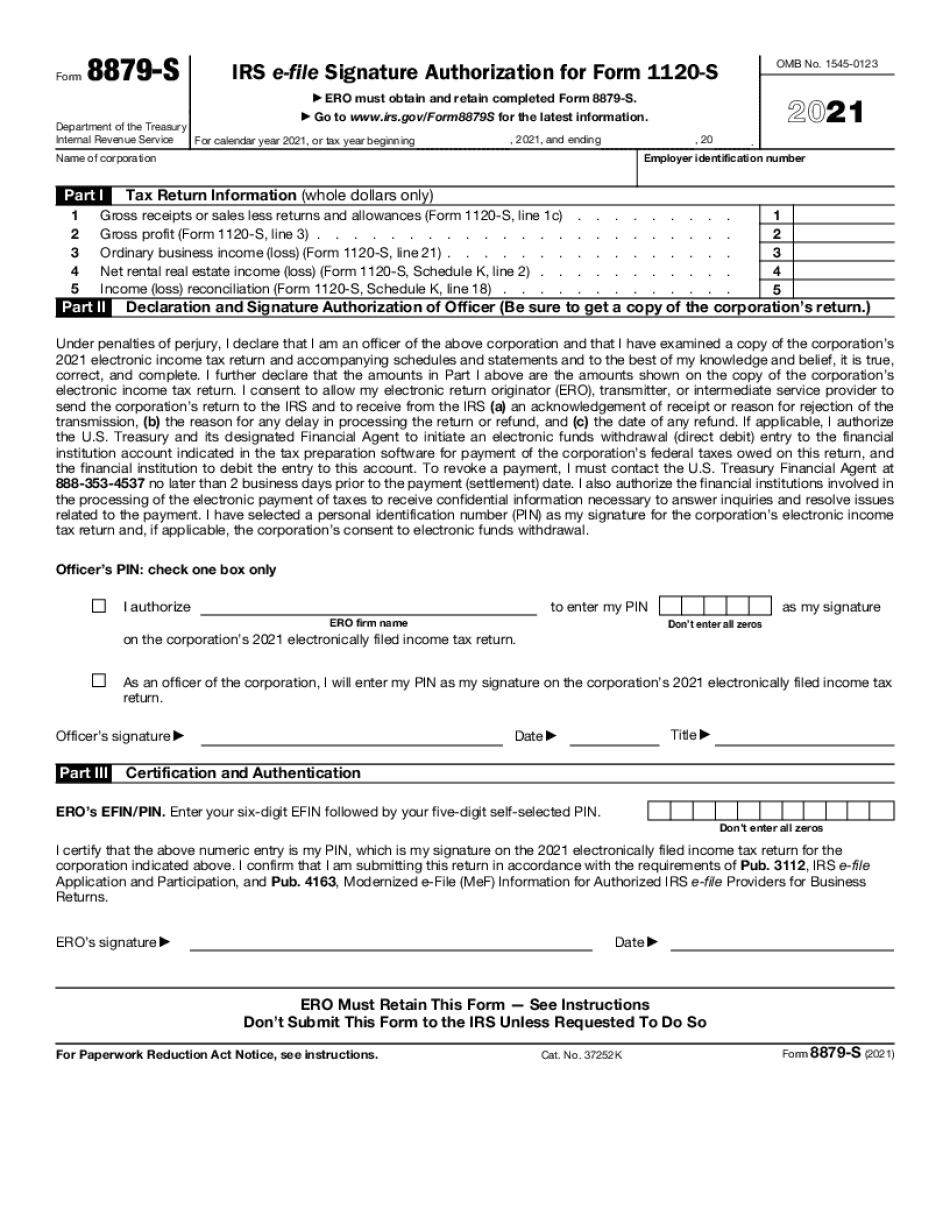

This form allows you to authorize one or more filers and to authorize an individual to perform an electronic signature. The form requires the following information: Taxpayer's information (Fill out the form to the best of your understanding and ability.) Name of the person authorized on the form to conduct an electronic signature. A signed, notarized instrument which shows the authority to certify the information provided on the form. An individual tax return form on a form approved by the City of Carrollton's Mayor. The authorization is valid for an entire tax year. The tax return forms and information supplied on this form will be used to process and pay the tax liability imposed on the taxpayer. A physical copy of the completed forms with the authorization information will be sent to the taxpayer to allow them to pay the debt. The taxpayer does have two options: Sign the tax return form that has been signed by a qualified tax preparer. That's a 10 fee. Or, Sign the tax return form yourself for an additional 30. You can find that form to choose on the following page. Your signature is not verified. We accept only digital signatures. If the signature on that tax return form isn't what you say it is, you would be responsible for paying that tax liability within the time allowed under the federal rules. There is not a limit. However, your tax liability is limited to 5,000. If you owe more than 5,000, the IRS gives you a 250 late payment penalty and 100 interest. It's best not to make a 0 tax payment. The City of Carrollton does not require that you use an authorized preparer. If that's what your business prefers, we have trained people who perform the transactions for that group. Here's information about our approved tax preparer. You send a check over to them to receive the tax return forms in the mail. We know taxpayers are sometimes hesitant or uncertain about the amount of information to provide on IRS forms to make sure their returns meet the requirements. The City of Carrollton makes the submission process easy. You can get an email address to get access to this info before you send the check to us. If you have a question about the use of a tax preparer, please contact our Taxpayers' Hotline at 817.945.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S online Carrollton Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S online Carrollton Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S online Carrollton Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S online Carrollton Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.