Award-winning PDF software

Form 8879-S for Tampa Florida: What You Should Know

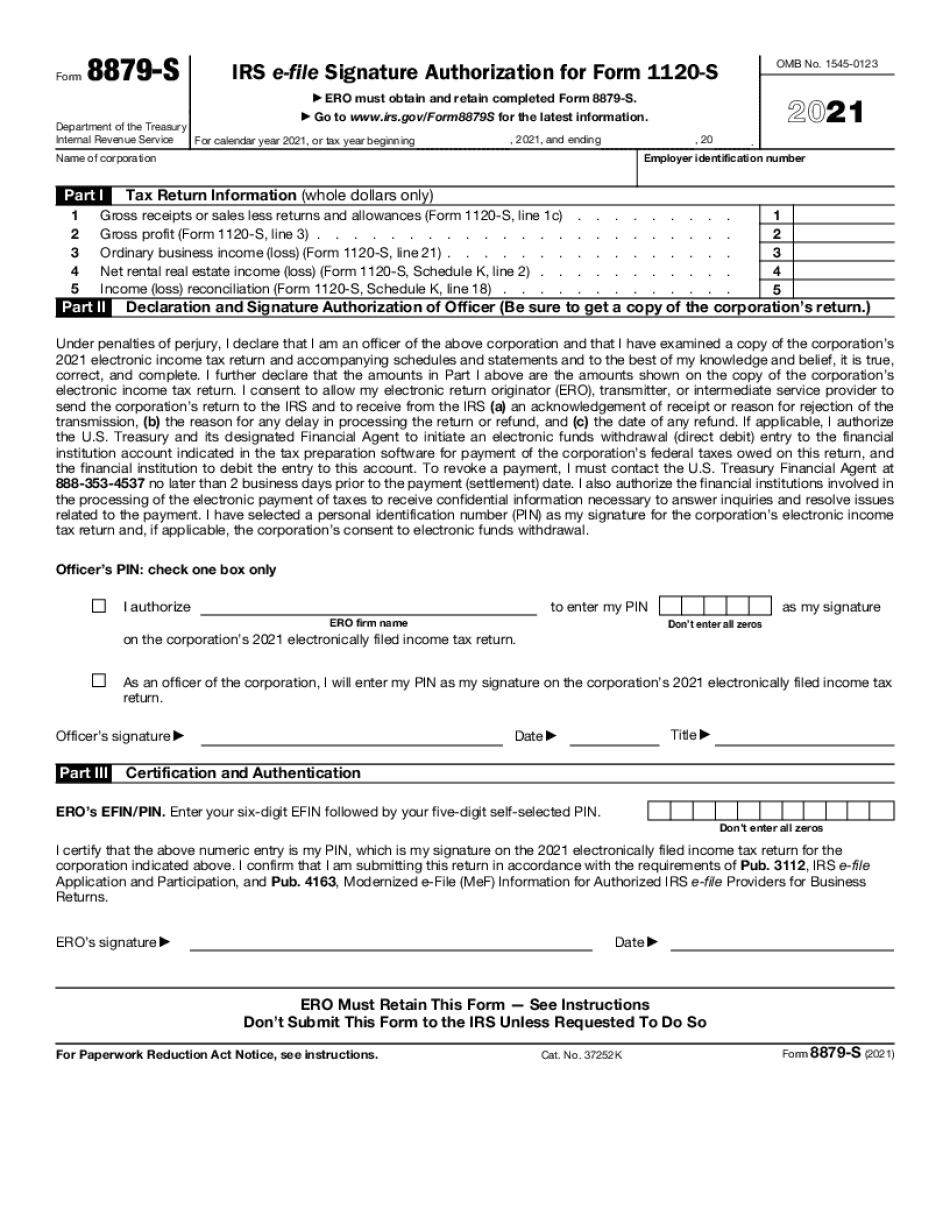

The filing form is designed to simplify the process for the Internal Revenue Service (IRS) when processing tax returns. The form will be used by S Corporations to report the income and expense information for federal taxation, and the company's gross receipts of all trade, business, and professional income. The form also includes the information required for the preparation and filing of federal and state tax returns. The form will be available on the Internet beginning January 1, 2023. The form will also be available on IRS.gov starting January 1, 2015, for the first time. Form 15-A: Exemption and Form 8938-A: Business Income Tax Return (2012) Form 15-A: Exemption for the Self-Employed Individual (Form 15-A) enables a business owner or individual employed by a business to have it withheld from their federal income tax. The employer and employee must apply jointly on Form 15-A to request an exemption. The exemption is equal to the first 9,075 of the taxpayer's gross income for the taxable year. The amount of exemption is reduced by 1 for each 9,075 over the exemption amount. The tax is withheld at the same rate and amount as if the taxpayer were an employee. Form 2555: Health Coverage Tax Credits and Tax Credits (2012) Form 2555: Health Coverage Tax Credits and Tax Credits provides information and instructions to assist individuals, employers, and the government to provide health coverage, or claim credits or rebates for tax purposes. The form was used by individuals on an income tax return. It provides for the identification and computation of health coverage tax credits and credits under the law and for the payment of tax credits. It is an additional document to form 1041, Form 1040A, or Form 1040. Form 2555: Exemption for the Self-Employed Individual (Form 2555) allows an individual to reduce the federal income tax by applying for an exemption for the self-employed individual. The taxpayer claims the credit by filing Form 2555 and furnishing an itemized return. Form 2655: Tax Inflation Adjustments for Tax Years 2014--2016 and for Certain Taxpayers (2016) For tax years beginning after December 31, 2016, and before January 1, 2017, the IRS has established a method of adjusting the inflation benchmark amounts to more closely reflect consumer inflation. The method for adjustments to the inflation benchmark amounts is provided by the Internal Revenue Code.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.