Award-winning PDF software

Form 8879-S for South Bend Indiana: What You Should Know

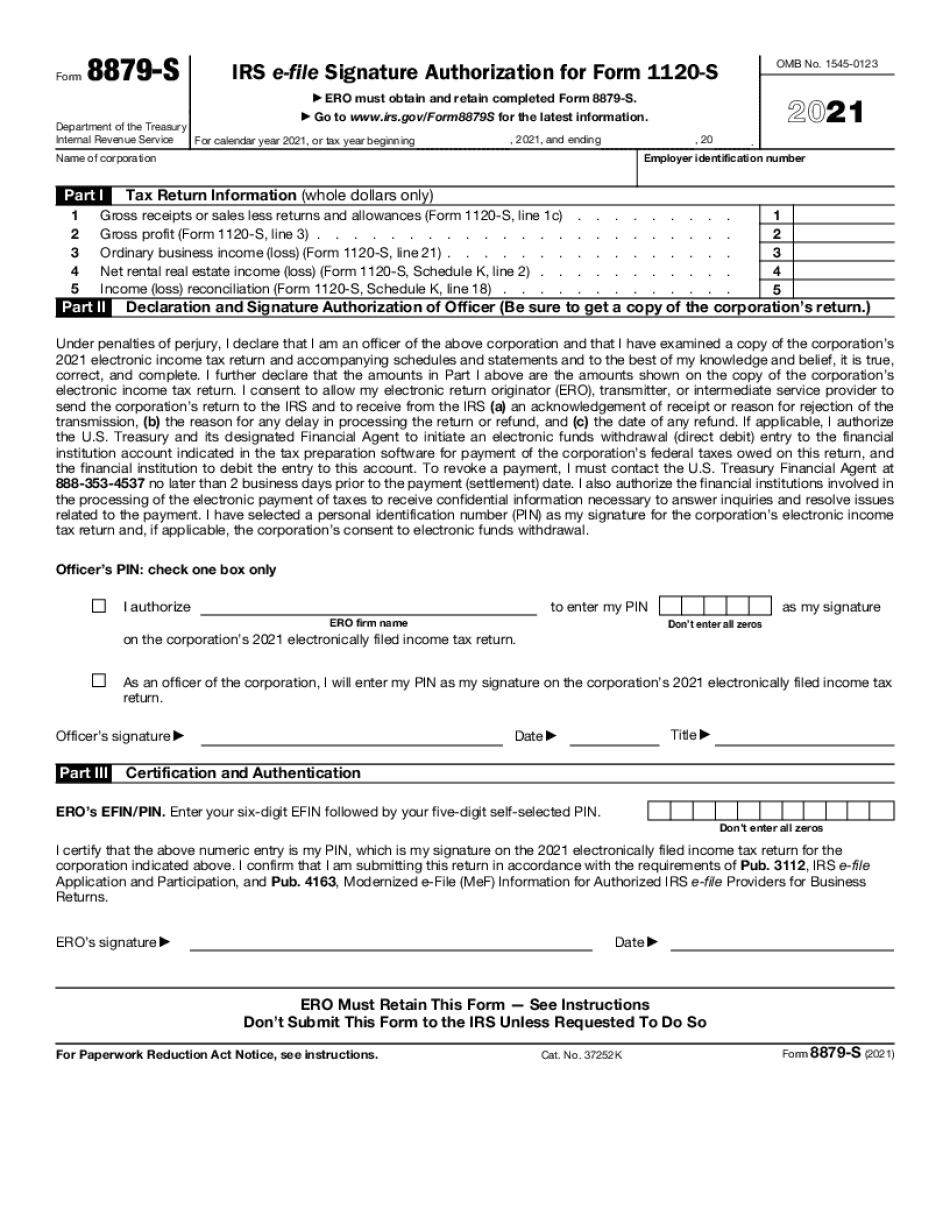

In addition, we are the designated funeral home at the C-J Memorial Cemetery in New York City. Read more... Read the complete form and instructions to determine if it is appropriate to file Form 8879-S on a private line or on the internet. The following instructions are for completing Form. There are instructions provided that list the required fields of Form 8879-S, as well, other items that may be requested. The procedures to complete and file Form 8879-S may vary depending on the needs of individual taxpayers. IR-2013-14 IT-8079 — IN.gov Read instruction on filing Form 8879 or IT-8879, which is a revised method for filing returns electronically. Note: A taxpayer may request that the Form 8879 or IT-8879 be submitted on paper or on the electronic filing system. Use Form 8879-S. Use the complete instructions (Form 8879-S) to determine if it is appropriate to file. The following instructions are for completing Form 8879 or IT-8879 or preparing for your electronic filing system. The completed Form 8879 or IT-8879 must be kept in a secure place for safekeeping, which includes at a place, account or location for electronic filing and mailing, or at a central location. It is an offense to remove Form 8879 or IT-8879 from its proper place of storage for secure keeping, without the permission of the Commissioner. If the taxpayer or taxpayer agent, including a taxpayer representative who is a taxpayer, agent or employee, signs Form 8879 or IT-8879, and it is returned to the taxpayer, the taxpayer is responsible for providing all supporting documentation and information to facilitate filing in accordance with the rules for the filing of Form 8879 or IT-8879 to a designated authority or to the appropriate tax authority of the taxing jurisdiction. See IR-2013-14, IR-12, Tax on Certain Financial Assets and Property, and IR-3, Form 8879 for more information. Read complete form directions. To receive a copy or transcript of your Form 8879 or IT-8879, or a copy by e-filed or if you desire a transcript of an EO, see IR-2014-16. IT-8049-E (IR-2051) — IN.gov Informative Note: This form was also used for taxpayers that have submitted their returns on paper.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-S for South Bend Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-S for South Bend Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-S for South Bend Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-S for South Bend Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.