Award-winning PDF software

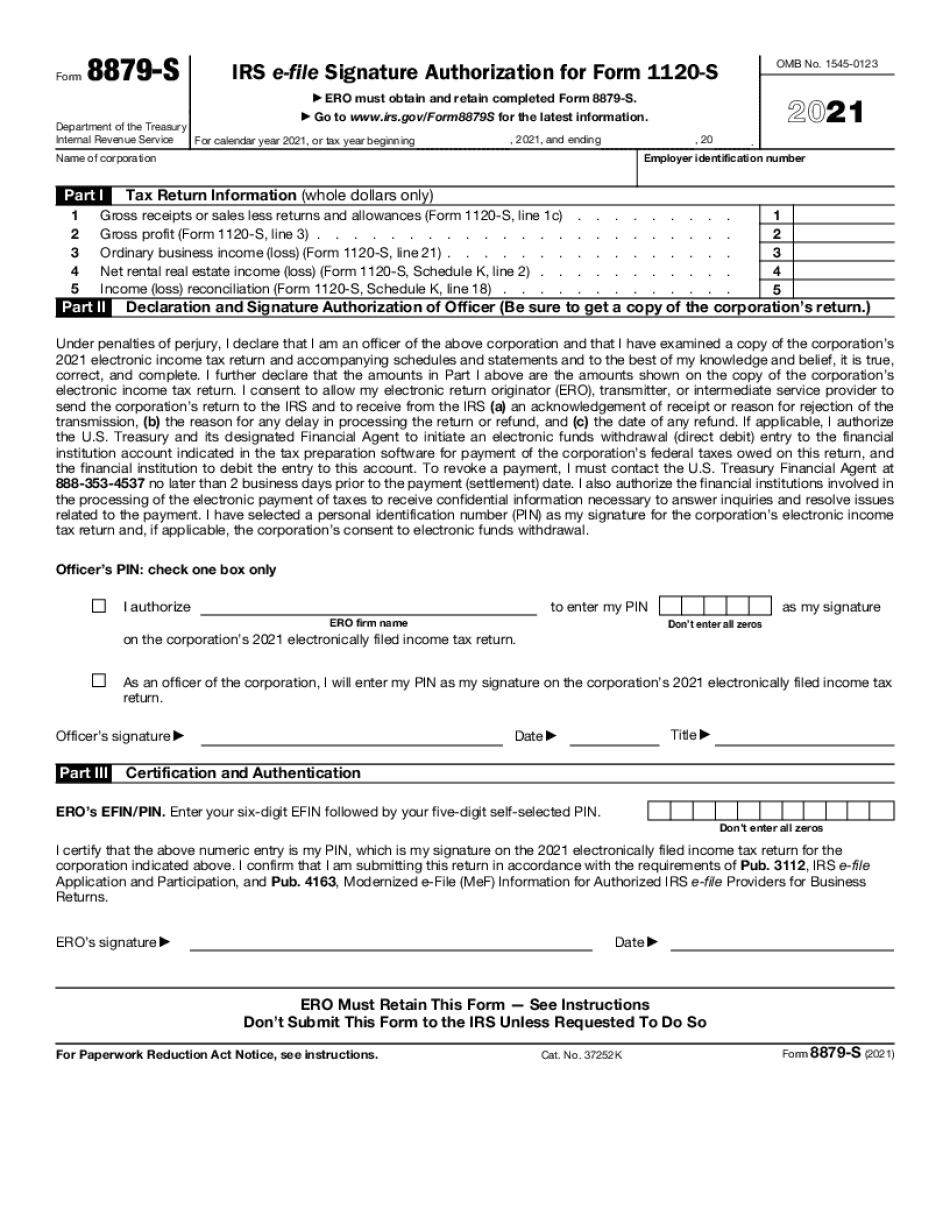

Cincinnati Ohio Form 8879-S: What You Should Know

In addition to falsifying IRS Form 8879, Taxpayer is involved in various frauds. In the case where the IRS receives a fraudulent return, it must report the fraudulent return with respect to Form 1120, and/or a summons and complaint with respect to Form 3881-ST. The fraudulent return must also be reported for the return year and indicator that the taxpayer is not eligible to file Form 1641 (or Form 8631) returns to evade tax. The IRS can request a copy of the completed forms with the return in order to be certain that the taxpayer knows the truth about the tax matters or is preparing and filing a false return. Taxpayer is responsible to comply with these requests. Fraudulent return prepared or filed is a crime. There is no set date when the fraudulent return is due, it is a matter of the determining when to report it for examination. If you do not have the proper authorization from the taxpayer, to prepare and file an electronic tax return to the IRS, you must provide an information packet containing a request to the taxpayer to authorize you to prepare and file their return for them on a date of their choosing. The complete packet (or the packet that best meets your needs) has the following items: • A return proof. This must be an actual, authentic receipt. This must be an actual, authentic receipt. A request that the taxpayer complete their own Form 1540 for the return year and pay all taxes on or before April 15 in the tax year. This is a general request to the taxpayer to provide your return (whether e-filed or paper) in their handwriting on a special piece of paper and place in a special place at their office. If the IRS has a hard copy of the return they need, this is not a hard copy, they have a computer printout. A request that the taxpayer submit a copy of the return to the IRS with the payment, if they have no hard copy of the return. A notice of a proposed assessment. A notice of additional assessment. A notice that the customer has 10 days to amend their return (if they have an e-File system).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cincinnati Ohio Form 8879-S, keep away from glitches and furnish it inside a timely method:

How to complete a Cincinnati Ohio Form 8879-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cincinnati Ohio Form 8879-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cincinnati Ohio Form 8879-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.