Award-winning PDF software

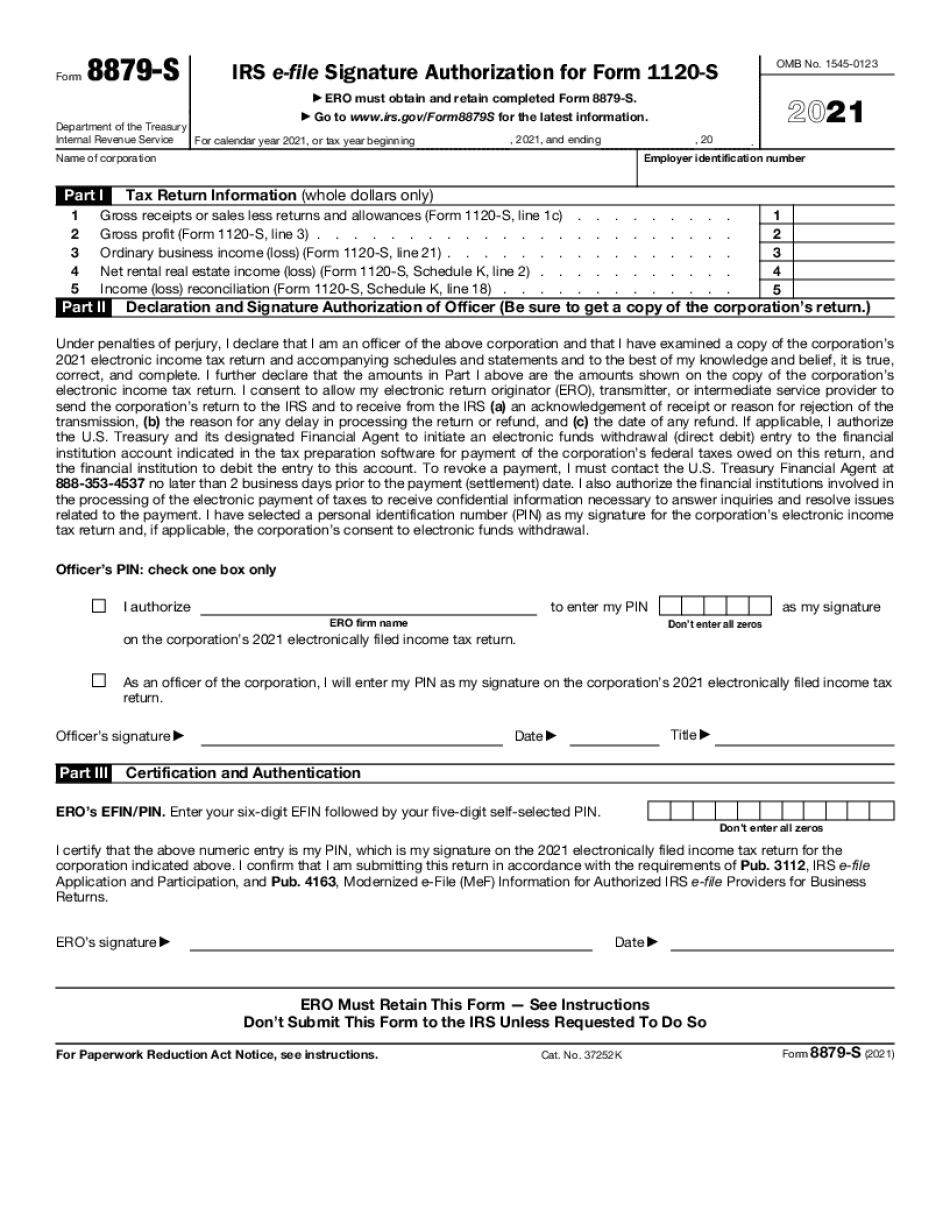

Form 8879-s

Follow your links for the following Eros. ERO mailing address(BS) for all tax return inquiries sent to an ERO are: ERO for Form 8938, Statement on the Form 8938. This should be sent by mail and does not need to be received by the ERO by fax or e-mail. ERO of Form 8899, Notice to Employee. This should be sent by mail and does not need to be received by the ERO by fax or e-mail. ERO of Form 709 and Form 710, Income Taxes Received by Nonresidents. This should be sent by mail and does not need to be received by the ERO by fax or e-mail. ERO of Form 709, Statement of Estimated Tax Paid for the Tax Year. (A list of Eros for tax year 2017 is available at the end of Form 8938, which you should forward to an ERO.) A list of Eros for.

form 8879-s " e-file signature authorization for form

It is designed for government officials to check whether their businesses are subject to any federal income tax liabilities. To make a tax-filing mistake looks bad in your business. In addition, you can make mistakes in your personal taxes. Some mistakes include: Understating your expenses or misusing the tax deduction you qualify for. Reporting your business income correctly or underreporting deductions. Taking additional credits instead of credits granted to you. This article will cover the most common tax mistakes that business owners make, and also explain how to fix those mistakes. As you do more research on a tax situation, it's a good idea to do some additional research on your own since your state can have their own tax requirements. You can also get legal help by using a service like LexisNexis Pro (see below).

10475: form 8879 - frequently asked questions

Gov e-mail and the taxpayer's e-mail address as its basis for generating and storing the electronic signature records. It uses the self-identified tax identification number as a basis for storing the electronic signature records; the system and software are designed to recognize the taxpayer's tax identification number, and automatically generate the necessary codes to authenticate them. The taxpayer's electronic signature should only be used to send e-filed material; any other use of the electronic signature in this regard could be illegal. The taxpayer does not have to sign this form; however, it is the taxpayer's responsibility to ensure that the e-filing software will be used to ensure and authenticate the signature. When a taxpayer fails to sign this form, the software will detect the problem and will provide an error message, which the taxpayer can use to correct the problem. The taxpayer is not responsible for any errors produced.

8879-s form | pdffiller

Print the form pages you need with this free PDF viewer. Don't print to a CD or tape, because the pages you print will not stay clean. You can also print pages you need with Adobe Reader. . Don't print to a CD or tape, because the pages you print will not stay clean. You can also print pages you need with Adobe Reader. Get the forms from Use the free IRS e-file service. The IRS e-file system uses the same basic format and forms as Form 1120S, and will send your electronically to the Department of the Treasury, where they'll be scanned and uploaded to the online system. You're now ready to send your application and Form 1120S to the IRS. To make sure the application and your forms get transferred to the correct site, visit. You also should save a copy of your completed application (Form 1120S) so that.

Fillable form 8879-s | edit, sign & download in pdf | pdfrun

These are used to file articles of incorporation electronically and when it is necessary for the corporate officers to sign the articles under penalty of perjury. Corporate Officers cannot use corporate seals, corporate flags, or other corporate emblems When a corporation's corporate seal is destroyed, a corporate officer may keep his personal seal as well. In this case, any corporate articles created within a corporation are valid as long as they still contain the seal's information. Therefore, all corporate articles created through a personal seal are valid to maintain any rights that the officer has to control or vote the corporation. Corporate Flags are not allowed As explained in the previous paragraph, corporate flags as well as the original corporate seal are not allowed. This is because flags are used to show which officers or directors sit on board and when the flag and seal are both destroyed, the officers or directors are removed.